Synchronised Earnings Growth Still Missing

Billy Toh & Samantha Ho / The Edge Financial Daily

February 20, 2018 08:47 am +08

KUALA LUMPUR: As we step into the fourth-quarter re sults reporting period following a disconnect seen in macroeconomic numbers and corporate earnings, investors are looking for signs that earnings recovery and growth will finally keep pace with the global economic growth seen in 2017.

The Edge Financial Daily takes a look at some of the results that have been announced so far in 2018 and whether the “missing growth” in 2017 would now be seen.

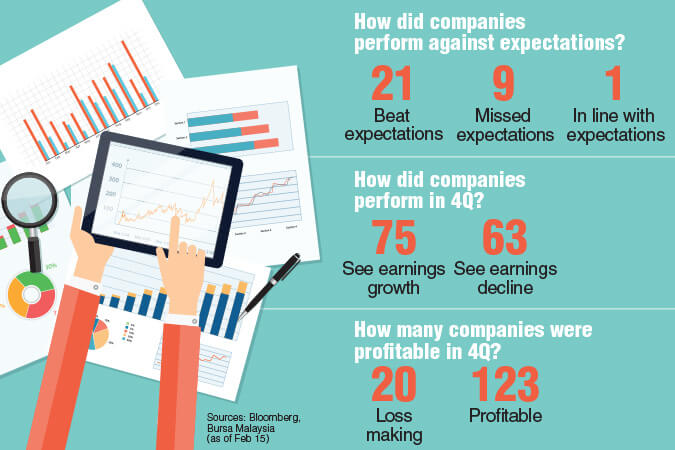

Based on the results reported as of Feb 15, the companies involved seem to have recorded an improvement in their bottom line although synchronised earnings growth remains to be seen. It is still early as more companies are expected to release their financial results after the lunar new year, but with 75 companies having registered year-on-year (y-o-y) profit growth as against 63 with declining earnings; things are definitely pointing towards an improvement.

Bloomberg data shows that 21 companies or 67.7% out of 31 companies covered by analysts outperformed expectations. Nine others failed to meet expectations and one was in line with consensus target.

Vizione Holdings Bhd is among the companies that have recorded significant y-o-y growth in quarterly earnings. After construction firm Wira Syukur (M) Sdn Bhd was injected into Vizione as part of a RM280 million reverse takeover exercise that was completed in October 2017, the group saw a significant increase in profit and revenue.

For its second quarter ended Nov 30, 2017, net profit jumped by more than 46 times to RM6.55 million while revenue rose by close to 15 times to RM147.3 million.

Similarly, jeweller Tomei Consolidated Bhd’s net profit for the fourth quarter ended Dec 31, 2017 (4QFY17) jumped by more than 19 times to RM4.4 million. The higher sales volume during year-end festivities had contributed to the better results.

Not all the companies managed to record growth in both the bottom line and top line. Cocoa manufacturer Guan Chong Bhd, for instance, saw its 4QFY17 net profit rise by more than 11 times to RM30.8 million despite a 9.2% fall in revenue to RM493.8 million. The higher profit was due mainly to an improved margin and an unrealised gain from commodity future contracts previously.

Lotte Chemical Titan Holdings Bhd, which endured a rather unfortunate start to its listing following some negative headlines last year, kicked off 2018 on a more positive note as its 4QFY17 net profit jumped 30% to RM378.2 million thanks to tax incentives. Its revenue was down 1.4% at RM2.12 billion.

Of the 143 companies that have released their financial results so far in 2018, only about 20 were in the red. Cement producer Tasek Corp Bhd posted a net loss of RM5.94 million in 4QFY17, against a net profit of RM2.14 million a year ago.

Similarly, housing developer Hua Yang Bhd recorded a net loss of RM0.96 million for the third quarter ended Dec 31, 2017 (3QFY18) as compared to a net profit of RM10.4 million in 3QFY17.

Will The Stronger Ringgit Hurt Exporters?

With the ringgit having strengthened by more than 10% against the US dollar over the past one year — to RM3.891 as of yesterday — there is a concern if exporters like glove manufacturers and semiconductor players could maintain their earnings growth.

Malaysian Pacific Industries Bhd (MPI) reported a 25% decline in its bottom line for the second quarter ended Dec 31, 2017 (2QFY18) due to a higher material cost arising from a commodity price surge and unfavourable foreign exchange difference. Following that, MPI’s share price fell from RM11.24 to below RM9.

Most analysts are of the view that earnings growth is crucial to keep the momentum in the domestic stock market, and if a company failed to meet expectations, price falls such as the one seen in MPI will not be a surprise.

However, KESM Industries Bhd saw a 13.6% growth in net profit for the first quarter ended Oct 31, 2017 to RM11.4 million on higher demand for burn-in and testing services.

Other semiconductor players such as Inari Amertron Bhd, Globetronics Technology Bhd, Unisem (M) Bhd and Vitrox Corp Bhd are expected to announce their quarterly results by Friday.

As for glove manufacturers, Hartalega Holdings Bhd saw its net profit for 3QFY18 jump 70.7% to RM113.0 million in line with the higher revenue achieved on higher sales demand and improvements in production capacity as well as lower costs, thanks to improvements in operational efficiencies.

Supermax Corp Bhd also saw its net profit rise 59.1% to RM35.9 million for 2QFY18. Kossan Rubber Industries Bhd is expected to announce its financial results by Friday.

A fund manager with a local asset management firm said that while the ringgit’s strength will have some impact on exporters’ earnings moving forward, the efficiencies and capacity expansion seen in the last few years will keep the growth momentum for them.

“If you look at those who will be most affected by a stronger ringgit, it should be the glove makers but they have continued to record growth in their earnings. We believe it’s the same for the semiconductor players as there is more demand for chips, not only in smartphones but also in vehicles as well as our daily lives,” he said.

Affin Hwang Investment Bank Bhd chief economist and research head Alan Tan said in a Feb 12 report that the manufacturing sector in 2018 is expected to be supported by higher demand for electrical & electronic (E&E) products, with global semiconductor sales likely to remain strong.

The Semiconductor Industry Association projected that the total global sales growth may exceed another US$400 billion (RM1.56 trillion) in 2018, after rising by 21.6% to US$412.2 billion in 2017, the industry’s highest-ever annual sales, Tan said.

He said the manufacturing sector output will recover in the first half of 2018, on expected higher demand from advanced economies, but with some seasonal distortions due to festive holidays in February.

The optimism was despite weaker E&E exports in December 2017, where the growth in Malaysia slowed sharply from 21.2% y-o-y in November to 6.2% y-o-y in December, the first single-digit growth in six months, at the back of slower demand from the US, European Union and the Asean region.

Sizable Impairment Could Be Over For O&G Players

After most oil and gas (O&G) companies suffered severe losses in the last few years following the oil price slump, investors are looking at survivors such as UMW Oil & Gas Corp Bhd, Sapura Energy Bhd and Barakah Offshore Petroleum. Sizable impairment is indeed something of the past for the industry.

Sapura Energy’s results for the third quarter ended Oct 31, 2017 have led to a downgrade by most analysts who are wary of a potential risk of impairment in the fourth quarter. Analysts also expect another round of impairment for UMW Oil & Gas in 4QFY17 to auditors’ requirements. Following this impairment, analysts are expecting depreciation expense to fall in subsequent years for the company.

MISC Bhd’s 4QFY17 net profit tumbled 87.1% to RM68.2 million, mainly dragged by a higher impairment loss of RM553.9 million previously. This serves as a reminder that the industry’s outlook may not be as smooth sailing as in the past.

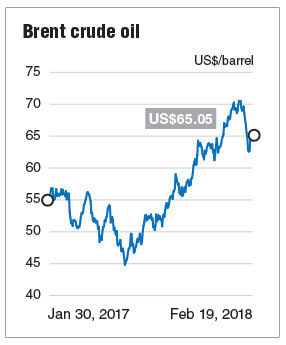

There was some optimism as brent crude oil touched a three-year high of US$70.53 per barrel in January. However, the price fell back after gushing US shale oil production threatened to drown an Organization of the Petroleum Exporting Countries (Opec)-led effort to clear a worldwide oil glut. It is currently trading at the US$65 level.

Dialog Bhd, which is involved in the upstream, mid-stream as well as downstream businesses, has maintained its consistent positive results with 2QFY18 net profit up 26.7% to RM115.8 million.

A fund manager told The Edge Financial Daily that earnings decline for O&G players are likely to moderate as most of the companies have worked towards a leaner cost structure and have done some kitchen-sinking exercises in 2015 and 2016, including asset impairments and conversion of short-term debt to long-term. Other efforts such as fleet rationalisation, labour force downsizing, renegotiations of terms with suppliers, as well as revamped internal operations have also been undertaken to improve efficiencies and cost savings.

Consumer Firms’ Earnings Hit By Rising Costs

Consumer firms have seen declining earnings over the past two years as most of them have absorbed the additional cost of doing business, such as higher raw material and transportation costs, in view of the weak sentiment in the past few years. The higher cost of doing business was mainly due to the weaker ringgit at the time.

According to Bloomberg data, only six out of the 23 consumer players have recorded earnings growth in 4QFY17. This was despite the sales and revenue growth seen in more than half of these companies.

Fraser & Neave Holdings Bhd (F&N) is among the larger cap players that reported lower earnings. Its net profit for 1QFY18 fell 16.1% to RM106.83 million on higher sugar prices and lower volume, though these were partly offset by operational cost savings and lower overheads. Other companies such as Hup Seng Industries Bhd, Zhulian Corp Bhd and Pensonic Holdings Bhd had also seen declines in earnings during the quarter.

TA Securities analyst Damia Othman said the late lunar new year festivities this year (compared to late January in 2017) had dampened the earnings recorded by F&N in 4QFY17, but net profit would improve going forward as commodity prices are seen to be falling, aided by a strengthening ringgit.

On top of that, consumer stocks are expected to remain attractive as defensive picks, as long as they continue to pay high dividends, Damia told The Edge Financial Daily.

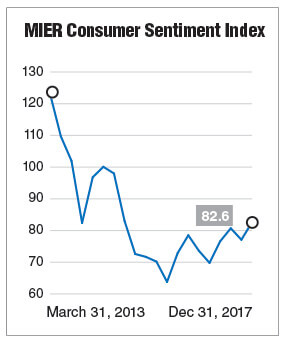

An analyst covering the consumer sector said revenue growth is an indication that businesses continue to gain traction at a reduced margin. “With the CSI (Consumer Sentiment Index) showing improvements, it is likely to see margin recovery as business owners pass on the cost to end users or through cost savings from automation, synergy and other expansion,” she said.

The CSI rose 5.5 points in the 4Q to a two-year high of 82.6, according to the Malaysian Institute of Economic Research. This, said an analyst, was the result of higher household and current incomes as well as an expectation of more employment opportunities.

No Surprises From FBM KLCI

Corporate earnings of FBM KLCI constituents appear to have fallen in line with consensus estimates so far, based on the reports of six out of 30 component stocks. Analysts have largely retained their “neutral” outlooks and “hold” recommendations on most of the large cap counters.

Maxis Bhd reported its highest profit after tax and minority interest of RM2.1 billion in four years for the year ended Dec 31, 2017 (FY17), which was still within expectations, according to Kenanga Research. DiGi.com Bhd, meanwhile, posted a 3.9% fall in 4QFY17 net profit to RM360.08 million, on higher finance costs but this came within consensus estimates and prompted a target price revision from CIMB Research to RM5.10 from RM5.

Tenaga Nasional Bhd’s net profit for the first quarter ended Nov 30, 2017 rose 24% to RM2.16 billion on the back of a stronger ringgit. CIMB Research, however, warned that the group’s earnings growth may slow down going forward as electricity demand and associate contribution slows down.

Among companies posting weaker earnings was Kuala Lumpur Kepong Bhd, which saw its net profit decline 11% to RM320.63 million for 1QFY18 on lower palm oil prices. The results came with “no major surprises”, according to Affin Hwang Capital Research.

KLCCP Stapled Group Bhd saw full-year earnings for 2017 decline 0.91% to RM877.9 million, dragged down by higher operating costs in its management services, meeting the expectations of MIDF Research, Maybank Investment Bank Research and CIMB Research.

According to Bloomberg data, earnings per share for all the stocks is estimated to grow at 3.22% over the next one year, with an estimated decline in price-earnings ratio from a current 16.71 times to 16.37 times by year end. Average dividends per share are projected to grow 2.98% in the next 12 months.

Construction firms with exposure to infrastructure work is expected to see better earnings

The onslaught of mega infrastructure projects in Malaysia, supported by an expected increase in Chinese investments on the back of the Belt and Road Initiative (BRI), has long been expected to boost growth in the construction sector.

As the financial results for small- and mid-cap construction stocks trickle in, most seem to have enjoyed improved revenue in the previous quarter but not all saw this growth reflected in their bottom line.

TRIplc Bhd was one of the standouts, seeing its net profit increasing fourfold to RM6.4 million for the second quarter ending Nov 30, 2017 as it collected triple the amount of revenue compared to a year ago from two maintenance concessions.

KKB Engineering Bhd, meanwhile, recorded a turnaround in 4QFY17 with a net profit of RM5.34 million, versus a net loss of RM4.06 a year earlier, as it saw revenue jump 2.7 times to RM70.17 million from its civil construction and steel pipe manufacturing divisions.

Another strong performer was Gabungan AQRS Bhd, which saw its 4QFY17 net profit double to RM15.23 million on higher revenue as the group moved into the more progressive construction stages. This included its work on the Sungai Besi–Ulu Kelang (SUKE) Highway, Pusat Pentadbiran Sultan Ahmad Shah and Light Rail Transit 3 (LRT3) projects.

On the flip side, WZ Satu posted what Affin Hwang Capital Research called a “disappointing” decline in earnings by 94% to RM497,000 million for 1QFY18 as it absorbed a RM1.3 million loss from an associate due to the ongoing ban on bauxite mining in Pahang.

Maybank Investment Bank Research had said in a note in January that it expects construction groups with work exposure to the second Mass Rapid Transit (MRT2) line, the MRT3 and the Pan Borneo Sarawak Highway to report relatively stronger earnings this year as work accelerates. Hong Leong Investment Bank Research, meanwhile, said that loan disbursements and approvals to the sector were seen growing at 13% and 20% y-o-y, while the sector’s development expenditure is at its highest level posted in the last six years.